אחריות תאגידית, (Corporate Social Responsibility) CSR, הולכת ומוטעמת כנורמה הכרחית בהתנהלות תאגידים. זהו הביטוי לסט הערכים המבטא התנהגות ארגונית כוללת, שארגונים משיתים על עצמם הכוללים (מעבר לרווח) היבטים של אחריות חברתית וסביבתית ומשולבים בעקרונות הקיימות. ארגון בעל אחריות תאגידית הוא ארגון המכיר בכך שהוא חלק מהמארג בו הוא פועל ואינו מבודד מסביבתו, מודע לתחומים בהם יש לו תרומה חיובית או שלילית לסביבה ולחברה, מגביר את הראשון ושואף לתקן ולהקטין את השני. מכיר שהוא בעל אחריות אמיתית כנה ושואף לעמוד במספר עקרונות אוניברסליים בד בבד עם הצלחה עסקית. CSR הוא המסגרת האסטרטגית-רעיונית לקראת יישום ממדי קיימות.

הדרך להעריך מחויבות ועמידה בערכים אילו נעשה ע”י הערכת נתוני ESG (Environmental-Society-Governance) של התאגיד. ESG הוא מסגרת שמטרתה להכניס לאסטרטגיית הארגון יכולת לזהות, להעריך ולנהל ערכי קיימות רלבנטיים לכלל בעלי העניין בתאגיד, אולם גם מאפשרים יצירת ערך אמיתי (מוניטרי) לארגון. CSR ו- ESG נמצאים על רצף אחד ולעיתים משמשים באופן חליפי זה עם זה. אם CSR הוא המסגרת האסטרטגית-רעיונית, ESG הוא שיטה המאפשרת מדידה של ממדי קיימות והכנסת ערך אמיתי לערכים שהם מייצגים, ובסופו של דבר להוות חלק מחובת הנאמנות של הארגון כמו יצירת רווח. התנהלות בהתאם גישות אילו תאפשר קיימות אמיתית וקיום עתידי בטוח. המגמה העכשווית לשילוב שיקולים אילו בהערכה של חברות ליצירת ערך מכונה Impact. מושג ערך ההשפעה משקלל את מידת ההשפעה של התאגיד על החברה והסביבה ומהווה שיקול אצל מקבלי ההחלטות ביחס לעידוד והסרת חסמים לפעילות בתחום מסויים וגם למשקיעים הרואים בנושאי קיימות ארוכת טווח חשיבות מהותית במדיניות ההשקעות שלהם.

בארץ ארגון “מעלה” ממפה וסוקר תהליכים ארגוניים של אחריות תאגידית ומדרג את נתוני ESG של חברות מובילות במשק. ציוני ESG לשנת 2022 של תאגידים בעלי השפעה סביבתית מוגברת מסקטורים שונים (הייטק ובטחון, כימיה ופרמצבטיקה, תעשייה ומזון, תשתיות ואנרגיה) נאספו עובדו ונותחו. לצורך השוואה וזיהוי מגמות כלליות בסקטור ספציפי הועלו נתוני מעלה על גרף “ראדאר” המאפשר השוואת לפי תחומים והשוואה בין תאגידים בתחום מסוים. כמו כן חושב ממוצע משוקלל של כל תאגיד בסקטור. השקלול מנרמל את כל ציוני התאגיד ללא התחומים שאין לגביהם נתוני דרוג (לדוגמה ממשל תאגידי לא נבחן בחברות פרטיות). בנוסף חושב לכל תאגיד בסקטור ציון סטנדרטי (Standard Score) המאפשר השוואה ישירה בין התאגידים בסקטור. נושאי ההערכה אוגדו לשלושת תחומי ESG (סביבה, חברה, ממשל) על מנת לאפשר השוואה מצומצמת ופשוטה יותר בין הסקטורים ונורמלו לסקלה של 1-10כפי שמתואר באיור הבא.

נראה שבתחום התרומה לקהילה, הציונים נמוכים בהשוואה לציונים בתחום איכות הסביבה והממשל. בולטות לרעה החברות בתחום תשתיות ואנרגיה בסקטור הדלק והתחבורה שהציונים גם בתחום איכות הסביבה נמוכים מהממוצע. סיבות אפשריות לתרומה הנמוכה לקהילה דורשות ניתוח סוציולוגי מעמיק והציונים הנמוכים בתחום איכות הסביבה נובעים ככל הנראה מניגוד אינטרסים מובנה בין פעילות החברות הנחשבת למזהמת ולא ידידותית לסביבה.

עלתה שאלה ביחס למהימנות הדיווחים והאם אין פה למעשה Greenwashing בו תאגידים מסחריים וציבוריים מסתתרים תחת סיסמאות ודרוגים “ירוקים” כאשר למעשה זהו רק מס שפתיים? בהנחת תום לב ושקלול העובדה שחלק משמעותי מהנתונים הוא כמותי ולא איכותני נראה שנתוני ESG של הדרוג מייצגים בצורה מהימנה את נושא אחריות תאגידית בחברות שנסקרו. החלק החסר בדרוג “מעלה” הוא שימוש בנתוני ESG להערכת הערך המוניטרי, “ערך ההשפעה” הממשי שיש לתאגיד, ערך מספרי המתאר את ההשפעה הכוללת שיש לארגון על סביבתו החברתית והפיזית. מגמת שימוש בערך ההשפעה על ידי “השקעות אימפקט” מסתמן כערך יסודי בגיבוש האסטרטגיה הכוללת של ארגונים ותאגידים ובעלי עניין. מתוך כך ברור שיש קשר הדוק בין ESG להשקעות אימפקט והם למעשה שני שלבים שונים בדרגת הקונקרטיות של התפיסות לקראת קיימות הוליסטית. בהסתכלות רחבה יותר, לא ארגונית אלא מדינתית ו/או גלובלית, 17 יעדי הקיימות של האו”ם (SDG) Sustainable developmentent Goals מהווים גם הם את המסגרת הרעיונית לקראת קידום קיימות מהותית וגלובלית.

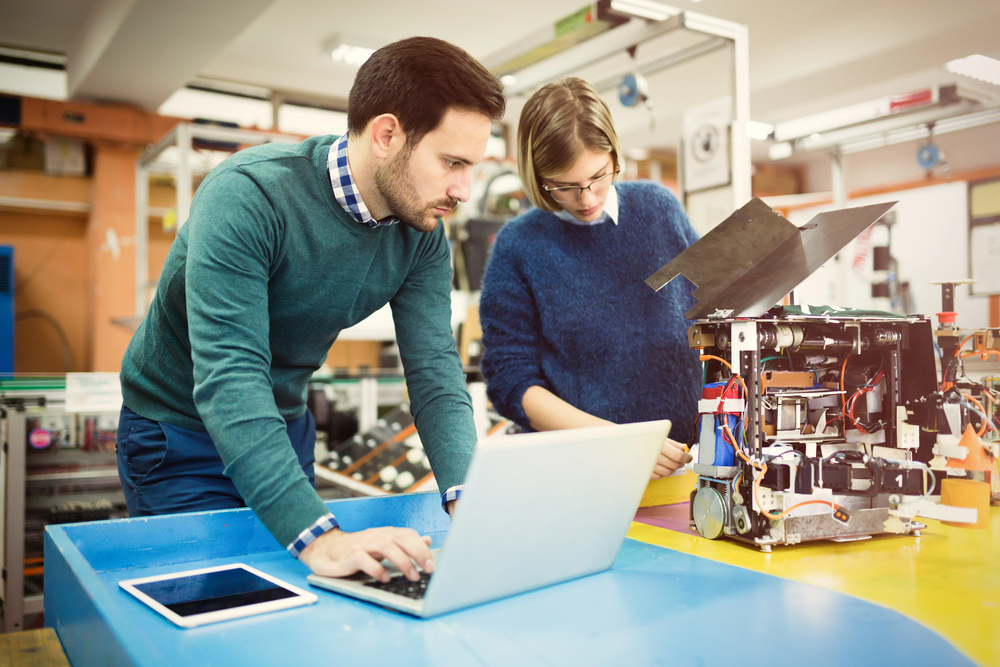

מגמות אילו משפיעות ותשפענה על צורות החשיבה הניהוליות העסקיות וההנדסיות בשנים הבאות. כדי שאפשר יהיה לנהל היבטים אלו בצורה מושכלת ואופטימלית לאורך זמן נדרש להטמיע צורות חשיבה אילו בתהליך החינוך של מהנדסי העתיד כחלק ממערך תהליכי התכן וההנדסה של מוצרים ומערכות והן כחלק מהתפקיד המנהיגותי של המהנדסים בחברות ובמשק. ההכשרה חייבת להכיל אלמנטים של הסתכלות רחבה כגון היבטיי הערכת מחזור חיים LCA)) Life Cycle Assessmentאחריות חברתית וסביבתית. ההכשרה העתידית חייבת לייצר מהנדסים ומדענים שהיבטים אילו הם חלק מה DNA והמנהיגות שלהם וחלק ממערכת השיקולים שלהם בבואם ליצור מוצר/תכן/תהליך חדש.